FAQs

![]()

In the FAQs section of this website, merchants can find answers to common questions related to integrating with the Segpay platform and utilizing the Merchant Portal.This section also lists other FAQ articles.

Merchant Portal

Learn more about adding a note in our article, How do I add a Note to a Consumer's Record?

Learn more about refunding a transaction in our article, How do I refund a transaction?

You can set up retention offers in the Merchant Portal.

-

Log into the Merchant Portal.

-

Go to the navigation menu and click My Website > Cancel Keep

-

Click the Add New Cancel/Keep Offer button.

-

Configure your discount offer and then click Save.

Learn more about setting up retention offers in our article, Cancel/Keep Retention Offers.

-

Enter your email address and click I'm not a robot captcha checkbox.

-

Click the button, Send password reset link to email

-

Check your email for a message containing a link to create a new password.

MID is an abbreviation for Merchant ID, a unique number assigned to your Segpay Merchant account. This number is generated when your account is added to the Merchant Portal and identifies you with the bank.

The MID number differs from the confirmation number you receive when submitting your application to become a Segpay Merchant.

Postbacks

-

Log into the Merchant Portal: https://mp.segpay.com/

-

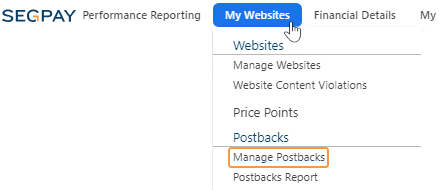

Navigate to My Websites > Manage Postbacks.

-

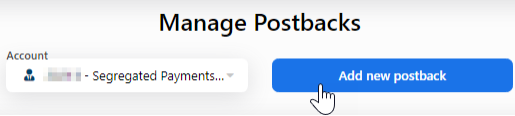

Click the Add New Postback button.

-

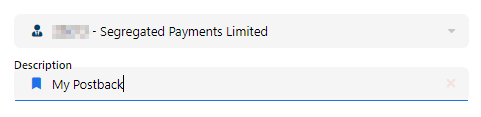

Configure postback settings by filling in the following fields:

-

Description: Enter a description for your postback.

-

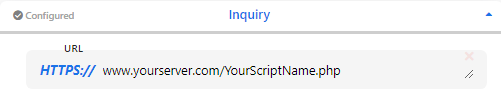

URL: The endpoint where Segpay will send the postback. Example:

www.yourserver.com/YourScriptName.php

-

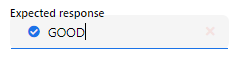

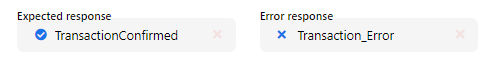

Expected Response: The confirmation text Segpay expects for a successful postback. Example: ‘

GOOD ’ or ‘OK ’.

-

Error Response: Notification text indicating a failed postback. Example: ‘

NOT_SUCCESSFUL ’.

-

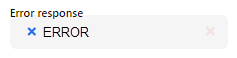

Failed Postback Notification Options:

-

Email: Enter an email to receive notifications for failed postbacks. Required if ‘Retry Postback’ is enabled.

-

Retry Postback: Check this box if you want to retry failed postbacks. Member Management postbacks retry every 5 minutes for up to an hour, and Transaction postbacks retry hourly for up to 12 hours.

-

-

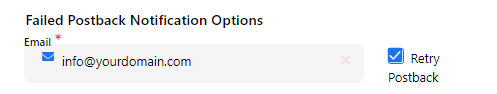

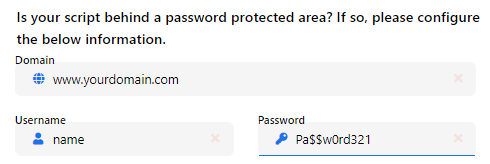

Password Protected Scripts (if applicable):

-

Domain: Re-enter the URL if it's password-protected.

-

Username/Password: Enter the credentials for accessing the URL.

-

-

-

Click Save to keep your postback configuration settings.

Make sure you're following these guidelines to configure and manage your postbacks correctly:

-

URL field: You do not need to enter

https:// in the postback URL field; it's added automatically.

-

Response Fields: When entering text in the response fields, use a simple data string such as

TransactionConfirmed . The postback will not work if you use spaces, line breaks, html, etc.

-

Validations: When you set up your system to process and validate incoming postback data, ensure that the validation process is not set up to require case-sensitivity. Postback communication can include upper and lower-case characters.

- Script Configuration: When configuring your scripts, it's crucial to accommodate both synchronous and asynchronous postback types:

Synchronous Postbacks (Inquiry, Enable, Disable): These require your server to respond within a specific timeframe. A timeout will occur without a timely response, impacting the postback's effectiveness.

Asynchronous Postbacks (Transaction): These do not require a response from your server. They operate independently, utilizing standard HTTP response codes to convey the outcome of a request. Ensure your server is set up to process transaction postbacks correctly, even though no return response to Segpay is necessary.

To effectively use Segpay postbacks, you need to meet these requirements:

1. Base URL:

Set up your Payment Page link (Base URL) before creating postbacks. The payment page is necessary for processing payments. Refer to the Base URL document for guidance.

2. Postback Script:

Setting up a server-side script is required to process Segpay postback data. Essential elements include Web Server/Hosting, Server-Side Script, and SSL Certificate. Obtain scripts through Pre-Built Solutions, Developer Hiring, or contact Segpay Tech Support for guidance.

3. Understanding Postback Types:

Segpay offers two postback types: Member Management and Transactional.

Member Management Postbacks

The system uses Member Management Postback types to notify you about a member's subscription status. You will receive notifications when a new username/password is created or a member signs up for or cancels a service.

-

Inquiry : Activated during payment when Segpay collects a username and password. This postback verifies if the username exists. If it does, it substitutes the username with the member's email address. Important: Ensure your scripts can accept email addresses as usernames. -

Enable : Notifies when to grant member access to the purchased service(s). -

Disable : Indicates when to revoke access due to subscription changes. -

Cancellation : Notifies for account cancellations or refunds. -

Reactivation : Triggered when an inactive account is reactivated.

Transactional Postbacks

-

TransPost : Activated for all transaction types.

4. Use Postback Parameters

A parameter is a variable element of a URL used to transmit specific information. In the case of Segpay postbacks, parameters send details about transactions or user actions. Each parameter consists of a key (the name of the parameter) and a value (the information it carries).

Adding parameters to your postback URL lets you specify the data you receive. If you don't add any parameters, all available parameters for that particular postback will be sent to you.

For a full list of available postback parameters, refer to our Postback Parameters document for more information.

For a full list of available postback parameters, refer to our Postback Parameters document for more information.

Pay Pages

Yes, Europe-based merchants can enable Dynamic Multi-Currency (DMC), which allows you to:

-

Force prices to default to a specific currency on the payment page.

-

Display prices in local currency, based on the consumer’s geographic location.

-

Let your consumers select which currency prices are displayed in before submitting payment.

Segpay Supports these Currencies:

| Parameter | Currency |

|---|---|

| &DMCURRENCY=AUD | Australian Dollar |

| &DMCURRENCY=CAD | Canadian Dollar |

| &DMCURRENCY=CHF | Swiss Franc |

| &DMCURRENCY=CZK | Czech Koruna |

| &DMCURRENCY=DKK | Danish Krona |

| &DMCURRENCY=EUR | Euro |

| &DMCURRENCY=GBP | British Pound |

| &DMCURRENCY=HKD | Hong Kong Dollar |

| &DMCURRENCY=ILS | Israeli Shekel |

| &DMCURRENCY=INR | Indian Rupee |

| &DMCURRENCY=JPY | Japanese Yen |

| &DMCURRENCY=NOK | Norwegian Krona |

| &DMCURRENCY=RUB | Russian Ruble |

| &DMCURRENCY=SEK | Swedish Krona |

| &DMCURRENCY=USD | US Dollar |

For more details on how DMC works, please see the Dynamic Multi-Currency section of our API document.

Europe-based merchants can contact techsupport@segpay.com to set up DMC.

Yes, you can choose one of 5 different pre-made templates: Pay Page Template Examples

For any other customizations including layout, color changes, or adding a logo to the top of the payment page, contact us at techsupport@segpay.com.

When requesting the Segpay payment page, you can include the pplist and/or ppview parameters to determine which price points are offered and how they appear. Here are a few examples of what you can do:

The following sample URL requests the payment page with two specific price points offered, using pplist:

https://secure2.segpay.com/billing/poset.cgi?x-eticketid=162209:3097&pplist=3097,1221

The following sample URL offers just one price point on the payment page, using ppviewoption:

https://secure2.segpay.com/billing/poset.cgi?x-eticketid=162209:3097&ppviewoption=2

The following sample URL offers all price points with radio buttons instead of a dropdown list, using ppviewtype:

https://secure2.segpay.com/billing/poset.cgi?x-eticketid=162209:3097&ppviewtype=2

For more information on these types of requests, please refer to Displaying Price Points found in our Processing API Guide.

No. We will go live with your join links once we thoroughly test them to ensure consumers will receive the right products or services at the right prices, so you can feel confident your consumers will get what they pay for.

SRS (Segpay Reporting Service)

Contact our Tech Support team at techsupport@segpay.com to request an SRS User ID and Access Key.

Once you receive you User ID and Access Key, you can start pulling various report data and consumer support tasks. Review our Segpay Reporting Service documentation for more details.

You can use SRS to perform the following tasks:

-

Cancel a membership (effective at the end of the subscription)

-

Expire a membership (effective immediately)

-

Refund a payment

-

Update a consumer’s login credentials

-

Change a recurring charge amount

-

Extend a membership by pushing the next recurring charge to a later date

-

Block an IP (from accessing one of your websites)

-

Block an email (from accessing one of your websites)

Yes, you can block specific emails or IP addresses using the Segpay Reporting Service (SRS).

For information on Blacklisting, see our Memberships page:

-

To blacklist an email address, review: Insert Merchant Fraud Email

-

To blacklist an IP address, review: Insert Merchant Fraud IP Address

For more information about using SRS, see our Segpay Processing API Guide

Support

-

Enter your Email Address and your Ticket ID on the login screen.

-

Click the Login button.

You’ll be taken to that specific ticket, with a link at the top of the page to view the tickets. Click that to see all your tickets, and select any ticket to add comments..

Transactions

It depends on why the rebill attempt was declined. If fraud is detected, the consumer's account will immediately be canceled. Otherwise, Segpay will try rebilling up to 3 more times over the next 9 days (re-trying once every 3 days). If the charge is still unsuccessful after 9 days, the account will be expired.

Note that failed rebill attempts do not alter a consumer's billing cycle. In other words, if a rebill attempt fails, the next billing date will be 30 days (or whatever the billing cycle is) from when the rebill failed, not when it was re-tried and succeeded.

F represents a Segpay internal fraud-related decline.

There could be several reasons the transaction was not approved. For example, the customer’s email or credit card may have been used previously in a fraudulent transaction.

If you have questions about a specific decline, contact techsupport@segpay.com.

Refunds and Voids are the result of a sale being reversed. However, there is a subtle difference between the two.

REFUNDS

A Refund occurs when a reversal request is made on a sale that was authorized and captured - this means the bank transferred the funds from the cardholder to the merchant to complete the transaction. For the refund to happen, a separate transaction request must be sent to return the funds to the cardholder. The cardholder's credit card statement will show the sale and the refund.

A refund can take 5-7 business days to display on the cardholder's credit card statement.

A Refund can also occur on auto-settled transactions (authorized and captured in one request), such as one-clicks and rebills.

VOIDS

A Void happens when a reversal request is made on a sale that was authorized but not yet captured. This will occur if a reversal request is received between when the sale was authorized and when it would have been captured. As the funds have yet to be transferred to the merchant, there is nothing to return, and a separate transaction request to return the funds to the cardholder is not required.

The cardholder's credit card statement may continue to show the authorization for several days ( the cardholder's bank determines how long the authorization will remain open and visible to their cardholder), after which the authorization will simply drop from the cardholder's credit card statement.

Merchants can check out the Refund/Void Reasons report in the Segpay Merchant Portal to see all of the Refunds and Voids processed in their account during a specified period.

F represents a Segpay internal fraud-related decline. There could be several reasons the transaction was not approved. For example, the customer's email or credit card may have been used previously in a fraudulent transaction.

If you have questions about a specific decline, contac techsupport@segpay.com.

Yes, if a postback fails to send following an initial purchase, we will re-try the postback every 5 minutes up to an hour later. For all other postbacks, we'll try again once an hour for the next 12 hours if an initial attempt fails.

If you entered your email address in the Postback area of the Merchant Portal, we will email you instructions if your postback still needs to be sent and is no longer being re-tried.

You can contact techsupport@segpay.com to customize how often your postbacks are re-tried.

A postback tracks and confirms events or transactions, such as the purchase of a product or service. The information sent in a postback notification can include transaction ID, amount, currency, and any additional parameters you want to track. This information is valuable because it provides reliable, real-time transaction updates that you can use for inventory management, accounting, or other business processes.

Segpay offers two categories of postbacks:

-

Member Management

-

Transactional

MEMBER MANAGEMENT POSTBACKS

Data is sent to you after signups, cancellations, or when a member creates a new username. You can set up 4 types of member management postbacks:

| Postback Type | Description |

|---|---|

| Inquiry |

Sends you the usernames created during signups to ensure they are available in your system. |

| Enable | Notifies you to grant access to a newly-registered member. |

| Disable | Informs you to remove access from members whose subscriptions reach the expiration date or if a cancel request was issued due to a refund or chargeback. |

| Cancellation | Notifies you that a member has requested cancellation of their account. The postback itself does not remove the member's access. |

TRANSACTIONAL POSTBACKS

Data is sent to you after each transaction regardless of approval or decline status. Examples: signups, conversions, rebills, one-clicks, refunds, voids, and chargebacks.

It depends on the type of postback. There are 4 types:

| Postback Type | Description |

|---|---|

| Inquiry, Enable and Transactional | Sent immediately after a sign-up, including one-click sales |

| Disable and Cancellation | Sent once the cancellation or expiration is processed by Segpay |

| Transactional for rebills, refunds, voids, and conversions | Get queued, and are sent within an hour of when the request is processed – except in the case of Instant Conversions, where the transactional postback confirming the upgrade is sent immediately |

| Transactional for chargebacks | Sent the same day the chargeback is processed |

For more information on stand-in processing, see our Stand-In Processing FAQ.