PayPal Integration Guide

We're excited to partner with PayPal to bring additional value to our merchants and continue providing flexibility in payments with a name that consumers already trust. This guide describes how to integrate PayPal into your websites with optional features to help manage your PayPal implementation.

PayPal Configuration

If you want to use PayPal with your payment pages, Segpay must enable it for your merchant account and websites. Once enabled, you can enable PayPal for any of your existing credit card packages, allowing you to accept both payment methods on your Segpay pay pages.

There's no need to create additional packages to use PayPal.

If you'd like PayPal enabled for your merchant account, contact your Account Manager or Tech Support.

Websites

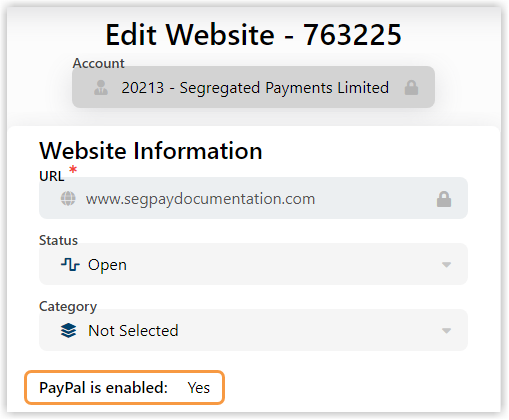

Once we enable your websites for PayPal, you will see the PayPal is enabled indicator on the Edit Website screen in the Merchant Portal.

For more information on websites, see our article, Manage Websites.

Packages

Once we enable PayPal for your Segpay merchant account, you can enable or disable it for each of your packages. When you enable PayPal for a package, your pay page displays the credit card and PayPal payment options. You don't need to create separate packages or join links to use PayPal.

We recommend not creating separate packages for different payment types since you can control which payment types display on your pay pages. The following sections in this document describe how to display payment options on your pay pages in different scenarios.

For more information on packages, see our article, Manage Packages .

Join Links

When you enable PayPal for a package, you won't have to make any changes to your existing pay page links. PayPal will automatically display on your page along with the credit card payment option.

If you want to set one of these options as your page's default payment method, you can easily do this by using the "Allowed Payment Types" feature with your join link. The next section explains how to do this using the allowedpaymenttypes parameter with your payment page link.

Using "Allowed Payment Types"

Segpay's payment pages offer an "Allowed Payment Types" feature. It lets you specify the payment options to display and set the default payment type. With this feature, you don't need custom payment pages for specific payment types, and you can target customers who prefer to use PayPal or credit cards.

You can also receive this data in postbacks as allowedpaymenttypes=pp.

As new payment options become available, we'll update this parameter accordingly.

Setting PayPal as the Default Option

This example shows how to make PayPal the default payment method on your pay page. PayPal is set as the default selection when the pp value (PayPal) is listed before the cc value (Credit Card).

Example:

Here's a working example of how to set PayPal as the default payment option if you've enabled your package for PayPal:

https://secure2.segpay.com/billing/poset.cgi?x-eticketid=202803:30686&allowedpaymenttypes=pp,ccResult:

Setting Credit Card as the Default Option

This example shows how to make Credit Card the default payment method on your pay page. Credit Card is set as the default selection when the cc value (Credit Card) is listed before the pp value (PayPal).

Example:

Here's a working example of how to set Credit Card as the default payment option if you've enabled your package for other payment methods such as PayPal:

https://secure2.segpay.com/billing/poset.cgi?x-eticketid=202803:30686&allowedpaymenttypes=cc,ppResult:

Show PayPal only

If you configured your package to use multiple payment methods but only want to show PayPal on your payment page, then only use the pp value with the allowedpaymenttypes parameter in your join link.

Example:

https://secure2.segpay.com/billing/poset.cgi?x-eticketid=202803:30686&allowedpaymenttypes=ppResult:

Show Credit Card Only

If you configured your package to use multiple payment methods but only want to show Credit Card on your payment page, then only use the cc value with the allowedpaymenttypes parameter in your join link.

Example:

https://secure2.segpay.com/billing/poset.cgi?x-eticketid=202803:30686&allowedpaymenttypes=ccResult:

One-Click Payments

You can use one-click payments with PayPal transactions, enabling consumers to make purchases with a single click to simplify the checkout process. When you set a price point to "One Click Enabled," and a consumer pays with PayPal, the outcome varies based on the type of price point. The following sections explain the differences between these price point types: One-Time, Recurring, and Instant Conversion.

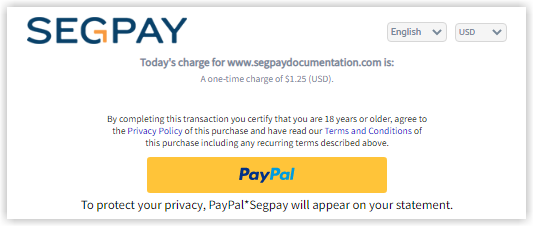

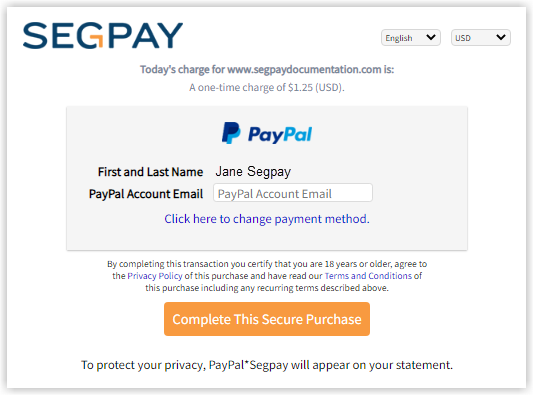

One-Time Price Points

One-time price points enabled for one-click payments make buying quick and easy. Consumers only need to input their PayPal email for subsequent purchases since the system reuses the existing purchase ID. This eliminates the need to go through the full PayPal sign-up process again.

Payment Page Example:

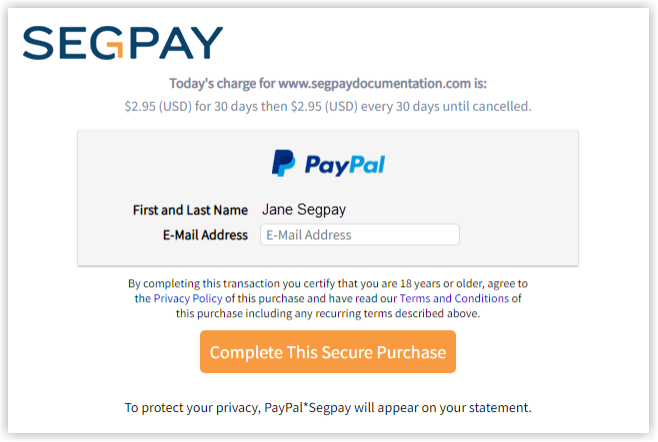

Recurring Price Points

Recurring price points enabled for one-click payments require consumers to go through the full PayPal sign-up process. This requirement is because each transaction generates a unique purchase ID and a new PayPal billing agreement. The same is also true for Instant Conversion and Dynamic Recurring price points. The consumer also has the option to pay with a credit card if they prefer.

Payment Page Example:

in

in

Instant Conversion

Instant Conversion directs consumers to a PayPal-only payment page. Like credit card transactions, they only need to provide their email address for a simplified checkout process. This eliminates the standard, more lengthy PayPal checkout process.

Payment Page Example:

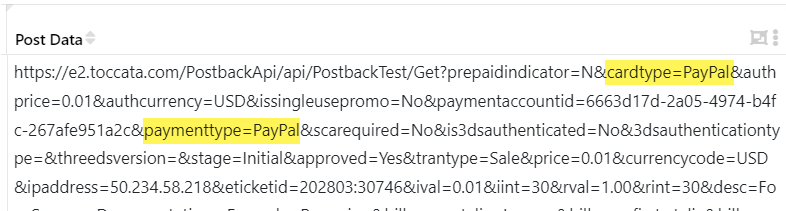

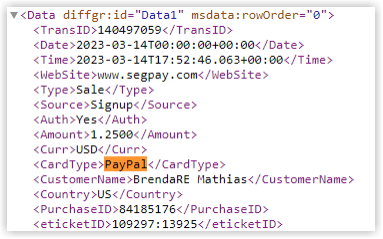

Postback Notification Upgrades

Segpay’s postbacks now show if a transaction was made using PayPal or a credit card. For each transaction postback, look for the two variables that show if it was a PayPal transaction:

-

cardtype=PayPal

-

paymenttype=PayPal

| Postback Notification Type | Description | Required Updates |

|---|---|---|

| Default | Segpay automatically appends all available variables and sends them to you. | None |

| Custom | You specify variables, their names, and order. | Add: cardtype= and paymenttype= |

Postback Data Example:

Reporting

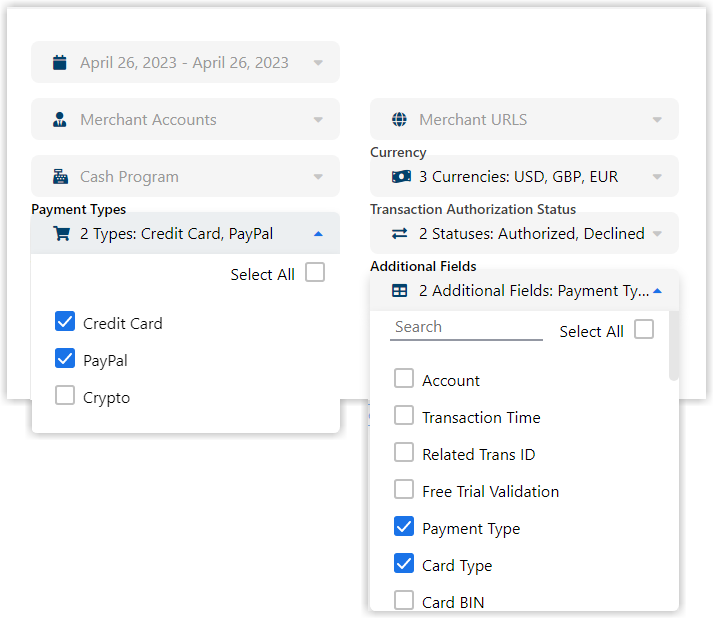

All reports have been updated to indicate whether a transaction was made using a credit card or PayPal. The following merchant portal reports now offer the ability to search exclusively for PayPal transactions or filter results by PayPal or credit card based on payment type column results:

Transaction Detail Report

Advanced options have been updated to include PayPal as a criteria selector under Payment Types, as well as the option to display card and payment types in the results.

Advanced Options

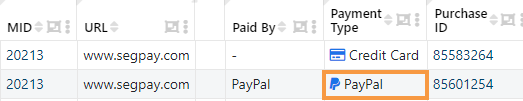

By selecting Payment Type and Card type in the advanced options, the values for that data are returned in the report results.

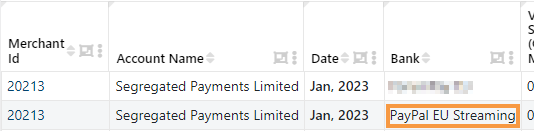

Detail Ledger Report

Advanced options were updated to include PayPal as a criteria selector under Payment Types as well as choosing whether to see the card and payment types in the results.

Report Results

By selecting Payment Type in the advanced options, the values are returned in the results.

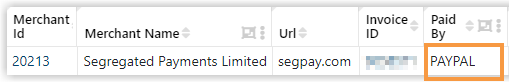

Invoices Report

PayPal transactions will be invoiced separately and can be identified in the invoices report in the Paid By column.

Chargeback Report

The Chargeback Report will let you filter on Bank to see your PayPal chargeback ratios.

CB Reversals (Chargeback Reversals)

A CB Reversal, short for Chargeback Reversal, is a new transaction type that you may see in your reports. A CB Reversal occurs when an external PayPal chargeback dispute was resolved in your favor. This means the original transaction was valid, and the disputed funds have been returned to your merchant account.

CB Reversal Process:

-

External Chargeback: A customer disputes a charge directly with their bank or credit card company (an "external" chargeback) instead of through PayPal's dispute resolution process. -

Dispute Resolution: The chargeback dispute is resolved in your favor, confirming the validity of the original transaction. -

CB Reversal Creation: Segpay's system automatically generates a new transaction called "CB Reversal." -

Funds Returned: The disputed amount is credited back to your merchant account as a positive entry in the CB Reversal transaction. -

Merchant Fee: A small processing fee is deducted from the returned funds. This fee is either $15 or half the original transaction amount, whichever is less.Merchant Fee Calculations for CB Reversals

-

$100 Transaction: The merchant fee would be $15 (since half of $100 is $50, and the fee is capped at $15).

-

$25 Transaction: The merchant fee would be $12.50 (since half of the transaction amount is under $15).

-

-

Notification: You'll receive a notification (postback) informing you of the CB Reversal. -

Reporting: CB Reversal transactions are clearly labeled in your transaction reports, such as the Transaction Detail Report and Detail Ledger Report.

-

Subscription/Access: CB Reversals do not reactivate any associated subscriptions or member access that may have been suspended due to the chargeback.

-

Customer Blacklist: The customer's information remains blacklisted within the Segpay system.

Other Reports

Other reports make it easy to identify and filter your PayPal transactions by showing PayPal as the card type. This includes the Approval Rates Report and Declined Transactions Report.

Segpay Reporting Service (SRS)

The Segpay Reporting Service has a report called TransactionsList. Sending a request for this report will return <CardType> values that include PayPal for all your PayPal transactions.

We've also formatted the SRS report,TransactionsPurchasesByURL, to include PayPal transactions in the <USERDATA> field.

For more information on the Segpay Reporting Service Transaction Reports, see our article, Transaction Details.

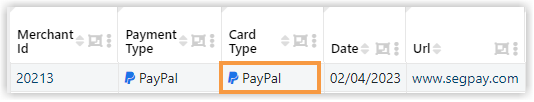

Managing Consumers

In the Merchant Portal you can run a consumer search to find purchase information by name, email address, Transaction ID, etc. The search report will show purchases made using PayPal in the Payment Type column.

PayPal Approved Countries

PayPal is a widely accepted payment method available in most countries around the world. However, due to varying financial regulations and restrictions, PayPal is not supported in some countries.

If your business operates in or targets customers from any of the countries listed below, PayPal will not be available as a payment option.

| Azerbaijan | India | Pakistan | Syria |

| Bangladesh | Indonesia | Papua | Thailand |

| Belarus | Iran | Philippines | Thailand |

| Botswana | Lebanon | Russia | Ukraine |

| Bulgaria | Libya | Saudi Arabia | Vietnam |

| China (PRC & Hong Kong SAR) |

Lithuania | Singapore | Turkey |

| Cuba | Malaysia | South Africa | Taiwan |

| Egypt | Malta | South Korea | |

| Estonia | New Guinea | Sri Lanka | |

| Guyana | North Korea | Sudan |