SEPA FAQ

This page addresses the frequently asked SEPA questions for Segpay merchants and their consumers.

General Questions

SEPA (Single Euro Payments Area) is the European Union's payment-processing network, similar to the ACH (Automated Clearing House) network in the United States. It enables European customers to make fast, secure, and convenient payments directly from their bank accounts in euros. Like using a debit card or initiating a bank transfer, SEPA facilitates one-time and recurring payments across the European Union and select non-EU countries.

Segpay's SEPA Direct Debit solution is available in 21 European countries, offering access to a large and diverse customer base. You can accept SEPA payments from customers in Austria, Belgium, Cyprus, Estonia, Finland, France, Germany, Greece, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Monaco, Netherlands, Portugal, San Marino, Slovakia, Slovenia, and Spain.

Offering SEPA as a payment method expands your European customer base, including those who prefer direct bank account payments or don't use credit cards. It simplifies cross-border transactions and streamlines reconciliation with your existing payout cycle. SEPA supports various transactions, including one-time purchases and recurring billing. Moreover, its strict security standards and mandatory SMS verification for new customers protect both your business and customers from fraud.

Segpay's SEPA solution supports various transaction types, including signups, one-click purchases, instant conversion, recurring billing, and reactivations.

A mandate is a customer's authorization for a merchant to collect future payments directly from their bank account. It's typically obtained during the customer's first SEPA transaction. A mandate allows customers to make one-click purchases and supports recurring billing.

SEPA funds are distributed to you within your regular payout cycle.

Merchant Setup and Configuration

Contact your Account Manager or Segpay Support to request SEPA activation. Segpay's Compliance team will review your request and grant approval, and a Segpay employee will enable SEPA for your MID.

Yes, you can manage which SEPA-supported countries are enabled for each payment package through the "Manage Packages" section of the Segpay Merchant Portal.

Consumer Experience

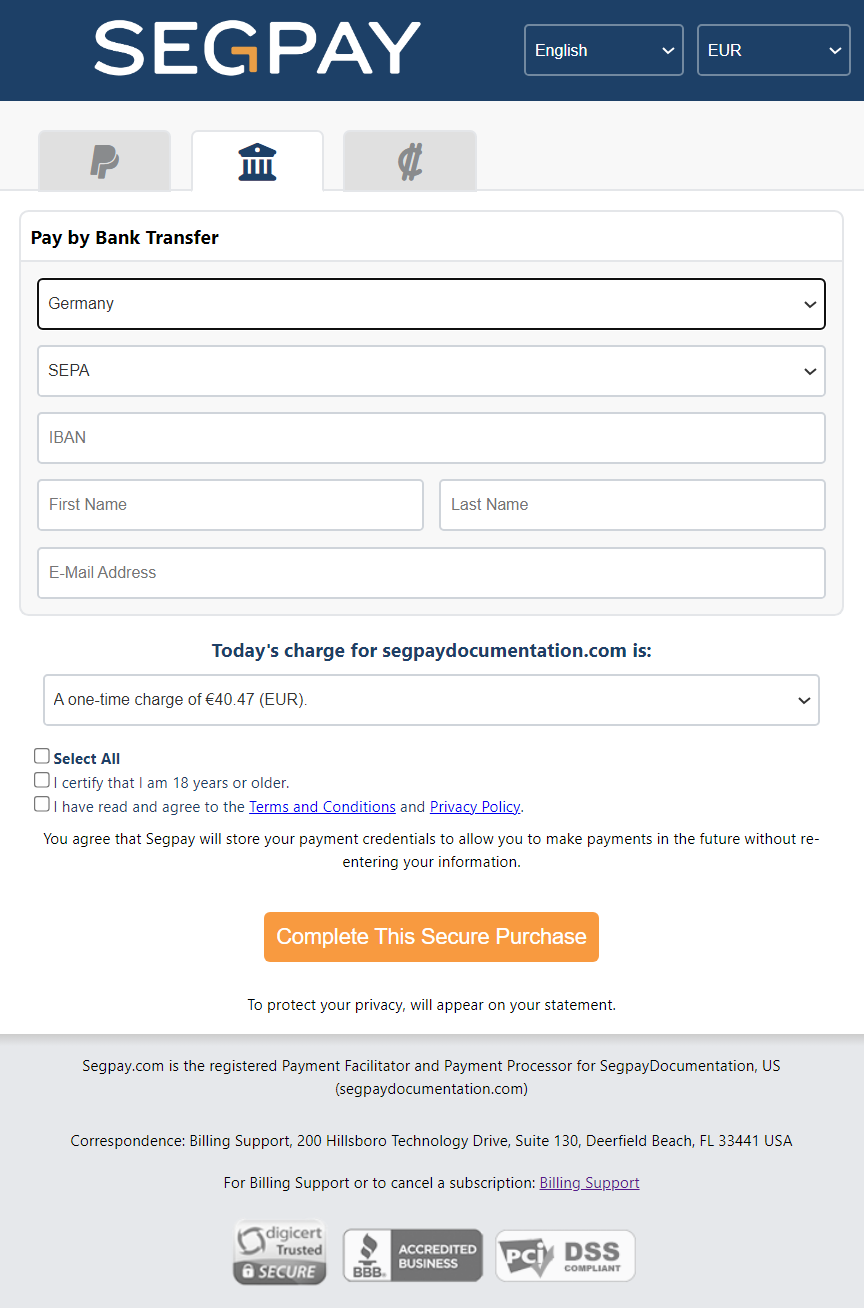

Customers select "Pay By Bank" on the Segpay payment page, choose their country, enter their banking details, and agree to the "Terms and Conditions" and "Privacy Policy."

If a customer doesn't have an active mandate—whether it's their first SEPA purchase, their previous mandate has expired, or they're buying in a new region—they'll need to verify their phone number with an SMS verification TAN (Transaction Authentication Number).

SEPA transactions are processed automatically for returning customers who have an active mandate and have previously made purchases using SEPA.

Customers have three attempts to enter the correct TAN (Transaction Authentication Number). If they fail all three attempts, the transaction will be declined.

Yes. Customers can search for SEPA purchases, view transaction details, and cancel transactions in the Segpay Consumer Portal. However, they cannot update payment information or cancel SEPA mandates through the portal.

Optimize the checkout experience for your European customers by customizing your payment flow. This can be achieved by:

-

Setting SEPA Direct Debit as the default payment method.

-

Setting the default currency to euros.

-

Specifying a target country from the 21 European countries where SEPA is available.

These customizations streamline the checkout process, reducing potential friction for customers and leading to increased conversions.

For detailed instructions, refer to the "Optimizing Your SEPA Payment Flow" section in our SEPA Getting Started Guide.

Additional Support

Please refer to the Segpay SEPA Getting Started Guide or contact Segpay Support for further assistance.