RDR FAQ

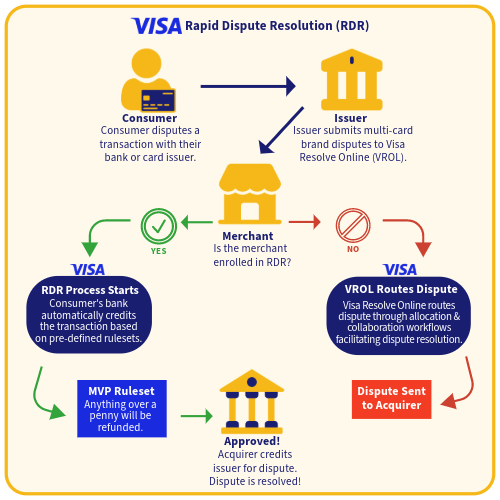

The Rapid Dispute Resolution (RDR) FAQ aims to help staff and merchants understand the RDR process for Visa transactions. It provides detailed answers to common questions about RDR, including how it simplifies dispute resolution for merchants, its benefits, and how it differs from traditional dispute-handling methods. The purpose is to provide users with the information they need to use RDR effectively, enhance dispute management strategies, and improve overall customer satisfaction.

General Information

RDR (Rapid Dispute Resolution) is a specialized service developed by Visa to efficiently manage and resolve disputes for Visa transactions. It automates the resolution process for customer disputes, commonly called chargebacks. RDR quickly evaluates each dispute and automatically refunds the customer.

Merchants who enroll in RDR benefit by minimizing chargebacks, as RDR-handled reversals do not impact their chargeback ratios. The service operates under a default rule: it automatically refunds any disputed transaction exceeding a penny, ensuring quick and efficient dispute resolution.

All merchants who process Visa transactions are potentially eligible for RDR, except for Payment Facilitator (PF) accounts, which currently cannot enroll (status to be determined). Presently, RDR is accessible exclusively to PSP accounts.

Merchants interested in using RDR should contact their Segpay Account Manager.

No, the RDR Fee applies explicitly to RDR reversal transactions processed on the Visa network, which includes both Visa credit and debit card transactions. It does not apply to transactions made with cards from other networks (such as MasterCard, American Express, or Discover) because the RDR service is tailored exclusively for handling disputes within the Visa system.

If you’re interested in using RDR, contact your Segpay Account Manager for enrollment information.

RDR and CDA both streamline dispute resolution, but they have distinct features:

-

Rulesets and Handling: RDR and CDA use rulesets for managing disputes but handle them differently. RDR is tailored for Visa transactions, automating the refund process directly through the acquiring bank for a streamlined resolution. Alternatively, CDA primarily focuses on dispute prevention for Visa and MasterCard by alerting merchants to potential issues before they escalate, allowing manual intervention. -

Enrollment Process: RDR enrollment requires using BIN (Bank Identification Number) & CAID (Card Acceptor ID), which are specific codes used to identify the merchant's bank and payment terminal or location. Fraud & Compliance, handle this. For CDA, enrollment involves DBA Descriptors, which are short texts appearing on cardholders' statements to identify transactions, aiding merchant identification during enrollment. -

Dispute Processing Fee: Please see your Account Rep for information on processing fees.

Benefits & Features

Rapid Dispute Resolution (RDR) is exclusive to the Visa network and offers several advantages to all parties involved in the transaction process:

-

For the Merchant's Chargeback Ratio: Unique to Visa transactions, disputes resolved through RDR do not impact the merchant's chargeback ratio. This aspect is vital for merchants to avoid penalties or the risk of account termination due to high chargeback ratios. -

For Consumers: Visa's RDR ensures immediate resolution and refunds for disputes, expediting the reversal process and enhancing consumer satisfaction and trust.

In summary, RDR's integration into the Visa network simplifies the dispute resolution process for credit card transactions, offering tangible benefits to all parties involved.

RDR quickly resolves disputes, enhancing customer satisfaction and trust in the transaction process. When a cardholder reports a dispute to Visa Resolve Online (VROL) that meets the merchant's predefined criteria, RDR promptly credits the cardholder's account through their issuing bank, significantly speeding up the resolution compared to the traditional, more time-consuming dispute process.

Yes, RDR plays a significant role in preventing chargebacks exclusively for Visa transactions. By automatically issuing refunds for disputes that meet specific predefined criteria, RDR resolves these issues before they escalate into chargebacks. This proactive approach mitigates the incidence of chargebacks and benefits merchants by ensuring that RDR-resolved disputes do not adversely affect their disputes-to-sales ratio. This is important for maintaining a healthy merchant account status and avoiding potential penalties associated with high chargeback ratios.

Yes. When customers check their account statement, they will see the original purchase and the refund together. The refund may appear as a standard reversal from their bank. They can also check "RDR Reversals" in the Consumer Portal for a more detailed view. This will show them the list of reversed transactions.

RDR (Rapid Dispute Resolution) is an automated system that makes resolving transaction disputes on the Visa network faster and easier.

Before RDR, it was necessary to manually review each dispute and decide whether to issue a refund or face the possibility of a chargeback with additional fees. This process involved assessing the claim's validity, which was time-consuming and complicated. With RDR, the dispute process is enhanced and streamlined, making it quicker and more efficient in these ways:

-

Streamlining Dispute Handling: Leveraging predefined rules, RDR automates dispute decision-making, removing the burden of manual review. -

Automating Customer Credits: For disputes that match specified RDR criteria, the system automatically processes a credit to the customer, quickly resolving the issue. This immediate action not only enhances customer satisfaction but also significantly reduces the administrative workload.

Compatibility & Usage

No. RDR is a service provided by Verifi, which is a part of Visa. It is only available for Visa transactions and does not apply to transactions processed through other card networks such as MasterCard, American Express, or Discover.

RDR works with all transactions processed in the Visa network, including credit and debit cards. However, prepaid Visa cards aren’t guaranteed to support this functionality.

Merchant Reporting

Merchants can identify RDR reversals across all reporting by looking for transactions with transaction type, "RDR Reversal."

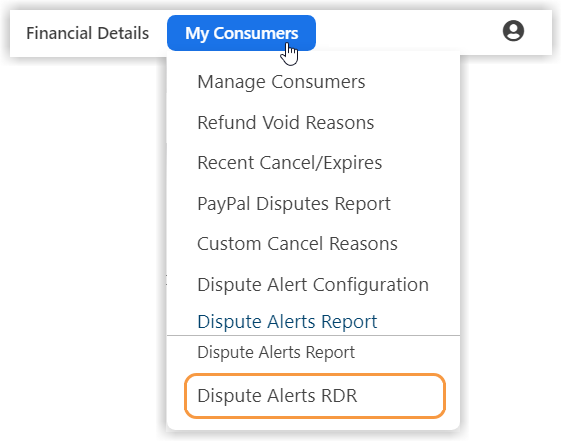

Merchants can view RDR reversals in the following reports:

-

Dispute Alerts RDR

-

Detail Ledger

-

Transaction Summary

-

Transaction Detail

-

Internal Income Report

-

SRS Revenue Summary By Source

The Segpay Merchant Portal offers reporting on RDR Reversals in My Consumers. The report is called: Dispute Alerts RDR.

Consumer Interaction

If a consumer disputes a Visa transaction resolved via an RDR Reversal, reviewing their bank statement is the easiest way to confirm a reversal. The statement will show the original purchase and the refund, indicating the transaction's reversal.

However, Segpay provides additional support to help consumers recognize when a reversal has occurred:

-

Confirmation Email from Segpay: Segpay sends confirmation emails to consumers after a transaction has been reversed through RDR, indicating that the dispute has been resolved and the transaction successfully reversed. -

Segpay Customer Service (CS) Portal: For extra clarity, consumers can check the Segpay CS Portal. If RDR has reversed a transaction, the portal will show a status update: "RDR Reversal on [Date]," specifying the reversal date.

While Segpay assists in these ways, the consumer's issuing bank is the most reliable source for confirmation and details regarding the reversal of disputed transactions.

When a consumer disputes a transaction made with a Visa card directly with their bank, here's the process:

-

Bank Intervention: The consumer's bank takes charge of the dispute process. -

Email Confirmation from Segpay: After the bank resolves the dispute, Segpay sends an email to the consumer confirming the resolution. This email advises the consumer to keep an eye on their account for the expected refund. -

Follow-up Action: If the refund doesn't show up in the consumer's account within a reasonable timeframe, Segpay recommends that the consumer reaches out directly to their issuing bank for further assistance.

Please note, this process is specific to transactions made on the Visa network. Disputes on other card networks, such as MasterCard, American Express, or Discover, follow a different resolution process and are not covered by the procedures mentioned here.

The time it takes for reversed funds to reflect in the consumer’s account can vary depending on the payment method and the bank's processing times. The consumer should contact their issuing bank for more information if the funds do not appear within this time frame.