Dispute Alerts FAQ

The Consumer Dispute Alert (CDA) Program is a Segpay feature that helps merchants reduce or avoid chargebacks. When a consumer disputes a purchase, the merchant receives an alert. The merchant can then take action to resolve the dispute before it turns into a chargeback by giving the consumer a refund. Merchants can also automate dispute resolutions so that they have more time to focus on their core business.

When a consumer disputes a charge on their credit or debit card, the card issuer initiates a process to start a reversal of the transaction. This process is called a chargeback and typically ends with the consumer receiving a refund and the charge being reversed on the merchant’s account. Additionally, the card issuer and acquiring banks will charge the merchant a fee for each chargeback to cover their costs for the reversal. The fees become even higher when a merchant receives too many chargebacks. A high number of chargebacks can result in fines, higher reserve requirements, and even losing the merchant account altogether.

A chargeback is sometimes referred to as a “reversal.” Other types of reversals include refunds initiated by the merchant and voids where a sale is reversed before it was finalized.

Chargebacks reduce a business' income and can lead to penalties if too many chargebacks occur. Chargeback fees typically rang from $25 - $100 per dispute, and merchants will pay the fees even if they win. Businesses also lose products sold or services rendered, adding to the costs. Visa and Mastercard track the count and amount of chargebacks, and this ratio, if above certain limits, can result in fines or even the loss of the ability of the merchant to process credit cards.

The advantage of the CDA program is that it gives merchants the power to decrease their chargebacks. With it, you can:

-

Protect your business from transaction disputes & chargebacks

-

Reduce disputes by up to 80%

-

Save time and money

-

Take on more risk, increasing your sales

Decreasing your chargebacks with the CDA program prevents:

-

Lost Revenue

-

Accruing High chargeback fees due to a high chargeback ratio

-

Paying Fines

-

Blacklisting your business

-

Inability to accept online payments

There is no charge to enroll.

Instead, you'll receive a Consumer Dispute Alert (CDA) fee for each alert received. This fee is smaller than the fee you would have been charged had the transaction become a chargeback. After you enroll in the program, you'll be able to view your CDA fee in the Segpay Merchant Portal under Merchant Info.

If you have questions about the fee, please contact your Sales Rep.

Your Segpay Sales Rep can enroll you. Let them know you're interested in the program, so they can register your descriptor and set your CDA fee. You can also contact them if you have any questions about enrollment.

This program may become mandatory for accounts with high chargeback ratios.

Chargebacks or reversals fall into these general categories:

| Category | Description |

|---|---|

| True Fraud | This is the most common reason for a chargeback. The purchase is made without the buyer's knowledge or consent. |

| Friendly Fraud | The cardholder makes the purchase but either does not recognize or remember the purchase and files a chargeback, or they deliberately abuse chargebacks to steal from the merchant. |

| Quality | The buyer never receives the item they paid for as expected or as advertised. |

| Merchant Error | A buyer is billed more than once for the same item, product gets damaged en route, the purchase arrives not as described, or the buyer makes a return, and a refund is due. |

There are two ways to see Consumer Dispute Alerts:

| Method | Description |

|---|---|

| View the Dispute Alerts Report |

Log into the Merchant Portal, and from the navigation menu select My Consumers > Dispute Alerts Report. Pull all the Pending alerts under Status. You can also use this page to manually resolve alerts. Resolving prior to the Expiration date gives you the best chance for avoiding a chargeback, although some may still be resolved successfully after the expiration date. |

| Receive Dispute Alerts by Email |

When one of your consumers files a dispute, you can choose to receive a dispute alert by email. The subject of the email will be: Consumer Dispute Alert for TransID %TransID% You have the option to configure multiple email addresses to receive these alerts. |

If you no longer want to receive dispute alert emails, you can change your configuration settings in the Merchant Portal under My Consumers > Dispute Alert Configuration. Or contact your Account Manager for assistance.

You can see additional information for a dispute in the Merchant Portal under My Consumers > Dispute Alerts Report.

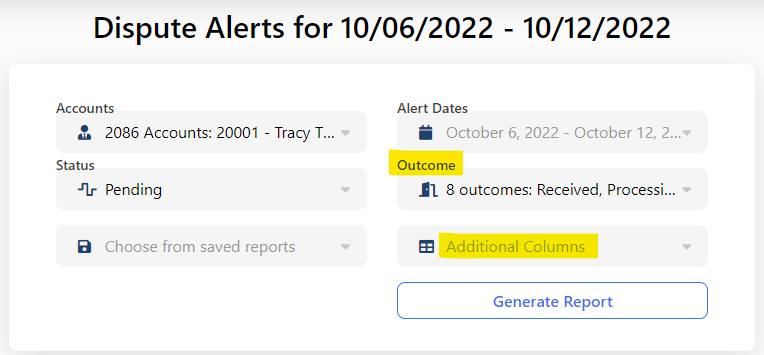

A Dispute Alerts Report shows you more information about any dispute. When generating your report, you can also select additional columns to see more information about how a dispute was resolved.

If you have more than one merchant account, you will only see the MerchantIDs in the merchant dropdown that are enrolled in the CDA program.

The Dispute Alerts Report shows consumer disputes. You can access it by logging into your Segpay Merchant Portal account, and navigating to My Consumers > Dispute Alerts Report.

Yes. You’ll need to manually resolve your alerts in the Merchant Portal by their expiration date (usually within 24 hours). This increases your chances of avoiding a chargeback.

Resolving disputes prior to the expiration date is your best chance for avoiding a chargeback.

Yes, you can reverse transactions shown on your Consumer Dispute Alerts report to avoid getting chargebacks. You can do this in the Merchant Portal by going to My Consumers > Dispute Alerts Report.

In the report, you’ll see checkboxes next to Pending alerts indicating the transaction hasn’t been reversed yet. You can use this to resolve the alert with a refund or by rejecting the alert.

Yes. By default you will see all Pending Alerts but you can also choose to see resolved alerts. You can find available options for search criteria under the Outcome field on the Dispute Alerts Report page. They are:

| Received | Processing | Stopped |

| Resolved | Not Found | Rejected |

| Declined | Other | All of the Above |

You can add additional fields to your report from the Additional Columns drop-down menu. They are:

| URL ID | Alert Descriptor | Currency |

| CardLastFour (lastfour) | CB Date (chargebackat) | Refund Date (creditdat) |

| Resolvedat | Resolvedby |